What is the Educational Improvement Tax Credit (EITC) Program?

The EITC program is a mechanism to allow companies to support innovative educational programs in exchange for a reduction in state tax. In 2020, Fox Chase’s Teen Research Internship Program became part of Pennsylvania’s eligible EITC innovative programs. Read more about TRIP and how to donate through the EITC mechanism below.

What is TRIP?

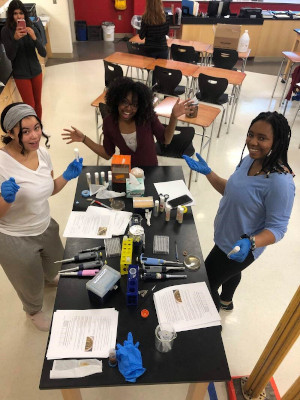

The Teen Research Internship Program (TRIP) is an exploratory program for high school students interested in careers in science, technology, engineering, art, and math (STEAM). During the program, students conduct hands-on research, build professional skills critical to STEAM careers and expand their network with a community of science enthusiasts. The program is taught by Fox Chase scientists at host institutions in both urban and suburban school settings in communities that Fox Chase serves.

TRIP Fosters Enthusiasm for Science Through:

- Self-driven and collaborative learning

- Network building with peers and professionals from across Philadelphia

- Exploring career paths across the STEAM landscape

- Near-peer mentorship from program alumni and one-on-one mentorship with STEAM professionals

- Designing research questions with real-world implications

Help More Students Explore Their Passion for Science!

Your support through EITC will allow Fox Chase to offer this program at no cost to all participants! Your tax-deductible contributions will directly support and expand the program. To donate, visit donate.foxchase.org/TRIP or download the brochure.

How Does it Work?

Contributions to Fox Chase through Pennsylvania’s EITC program allow companies to support Fox Chase’s vital, high-quality educational programs serving public school students in the Greater Philadelphia region while also receiving a significantly smaller state tax bill. Through EITC, eligible Pennsylvania companies can receive tax credits equal to 75 percent of their contribution (up to $750,000 per taxable year), or up to 90 percent for two-year charitable commitments. For more information, please visit dced.pa.gov.

Your company’s charitable giving becomes a low-cost gift when you redirect your state business taxes to the participating EIO of your choice.

- A one-year commitment will earn you a state tax credit of 75% of your contribution. A business that agrees to provide the same amount for two consecutive tax years will earn a credit of 90%.

- The non-credited portion of the gift can be claimed as a charitable contribution for federal tax purposes.

- Businesses may request up to $750,000 in tax credits per year.

- Eligible entities include businesses subject to the following taxes:

- Corporate Net Income Tax

- Capital Stock/Foreign Franchise Tax

- Bank Shares Tax

- Title Insurance and Trust Company Shares Tax

- Insurance Premiums Tax

- Mutual Thrift Tax

- Gross Receipts Tax

- Tax under the Insurance Company Law of 1921

- Personal Income Tax

How Does My Company Apply?

All applicants are required to submit applications electronically through dced.pa.gov. The business application guide explains the process of applying. Businesses must apply specifically for EIO credits if they wish to support Fox Chase’s programs.

New businesses may apply beginning July 1. Applications are approved on a first-come, first-served basis by date submitted.

The Department of Community and Economic Development will send an approval letter to businesses awarded educational improvement tax credits. The business then has 60 days to send its philanthropic contribution to Fox Chase Cancer Center, Corporate and Foundation Relations, Institutional Advancement, 333 Cottman Avenue, Philadelphia, PA 19111. Fox Chase will issue a gift acknowledgment which the business must send to the Department of Community and Economic Development within 90 days of the original approval letter. After sharing this written acknowledgment with the department, the business will receive the amount of tax credits outlined in the original approval letter.

For More Information

For specific information on how this program can benefit your business please contact your accountant and/or financial advisor.

For more information about donating to TRIP through the EITC program, please contact:

Lisa Broida Bailey

Director of Corporate & Foundation Relations

[email protected]

215-728-2745

Fox Chase Cancer Center is grateful for all contributions through the EITC Program.

The official registration and financial information of the Institute for Cancer Research at Fox Chase Cancer Center may be obtained from the Pennsylvania Department of State by calling toll-free, within Pennsylvania, 1-800-732-0999. Registration does not imply endorsement.